With Medicare Open Enrollment currently underway (October 15th through December 7th) we thought this would be a good time to review some basic facts about Medicare. So if you have chronic lung disease like Pulmonary Arterial Hypertension or Pulmonary Fibrosis, here’s what you need to know.

With Medicare Open Enrollment currently underway (October 15th through December 7th) we thought this would be a good time to review some basic facts about Medicare. So if you have chronic lung disease like Pulmonary Arterial Hypertension or Pulmonary Fibrosis, here’s what you need to know.

What is Medicare?

Medicare is the federal health insurance program for people 65 and older and people with disabilities. The different parts of the Medicare system pay for medical care including hospitalizations, physician visits, prescription drugs, skilled nursing facility care, home health care, hospice care and preventive services.

What Are The Different Parts of Medicare?

Medicare is broken up into 4 different parts: Medicare Part A, Medicare Part B, Medicare Part C and Medicare D.

Medicare Part A

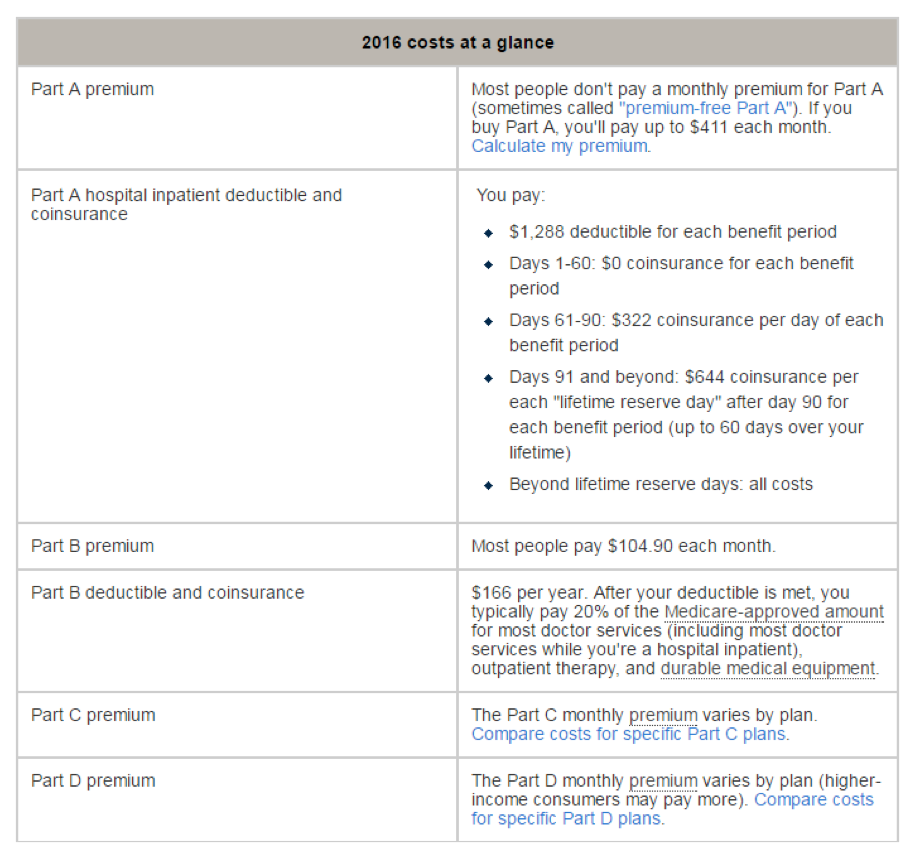

Medicare Part A is the hospital insurance. It covers inpatient hospital stays and limited time in skilled nursing facilities. It also covers some home health visits and hospice care. US citizens are automatically enrolled in Medicare Part A when they turn 65. If you have worked for at least 10 years and paid Medicare taxes you are eligible for Part A without paying premiums. Part A benefits are subject to a deductible per benefit period and beneficiaries have a coinsurance amount for extended inpatient hospital and skilled nursing facility stays. In 2016 the deductible was $1,288.

Medicare Part B

Medicare Part B is medical insurance and covers certain non-hospital medical expenses such as physician visits, outpatient services like blood work and x-rays, preventive services, and some home health visits. There is a premium for Part B usually around $104.90 per month but can vary based on income. There is also a deductible of $166/year and a 20% co-insurance after the deductible is met. Some services are exempt from the deductible and coinsurance such as an annual wellness visit and some preventative services.

Medicare Part C

Medicare Part C is also known as the Medicare Advantage program. In this Part, beneficiaries have the option to pay to enroll in a private healthcare plan and receive all Medicare covered Part A and B benefits and sometimes Part D (prescription) benefits. Patients enrolling in an optional Medicare Advantage program must also have Medicare Part A and Part B. The Medicare Advantage plans are required to cover all Medicare Part A and Medicare Part B benefits except for hospice care but they may cover additional services not covered by Part A or Part B. Each Medicare Advantage program is different and has a different cost associated with it.

Medicare Part D

Medicare Part D covers outpatient prescription drugs through private companies that contract with Medicare. Enrollment in Part D plans is voluntary and is usually part of a Medicare Advantage plan. Participants pay monthly premiums and “cost sharing” for prescriptions. Specific costs vary from Part D plan to Part D Plan.

Medicare Supplement or Medigap Policies

In addition to the different Parts of Medicare, Medicare Supplement or Medigap plans are also available. These plans help pay for some health care costs not covered by Original Medicare. You are only guaranteed a Medigap plan within the first six months of both being 65 or older and being enrolled in Medicare Part B. If that time has passed you can be denied for Medigap insurance based on your health.